Property Address:

100 Summit, Hagerstown MD21740

Property Type:

Multiple Use, Office, Hospitality, Restaurant

Property Size:

53,514 Square Feet Building Total Land Acreage

Minimum Investment:

$25,000

Offer Deadline:

August 7, 2024

Target Distribution Start Date:

January 31, 2025

Sales Price:

$3,490,000

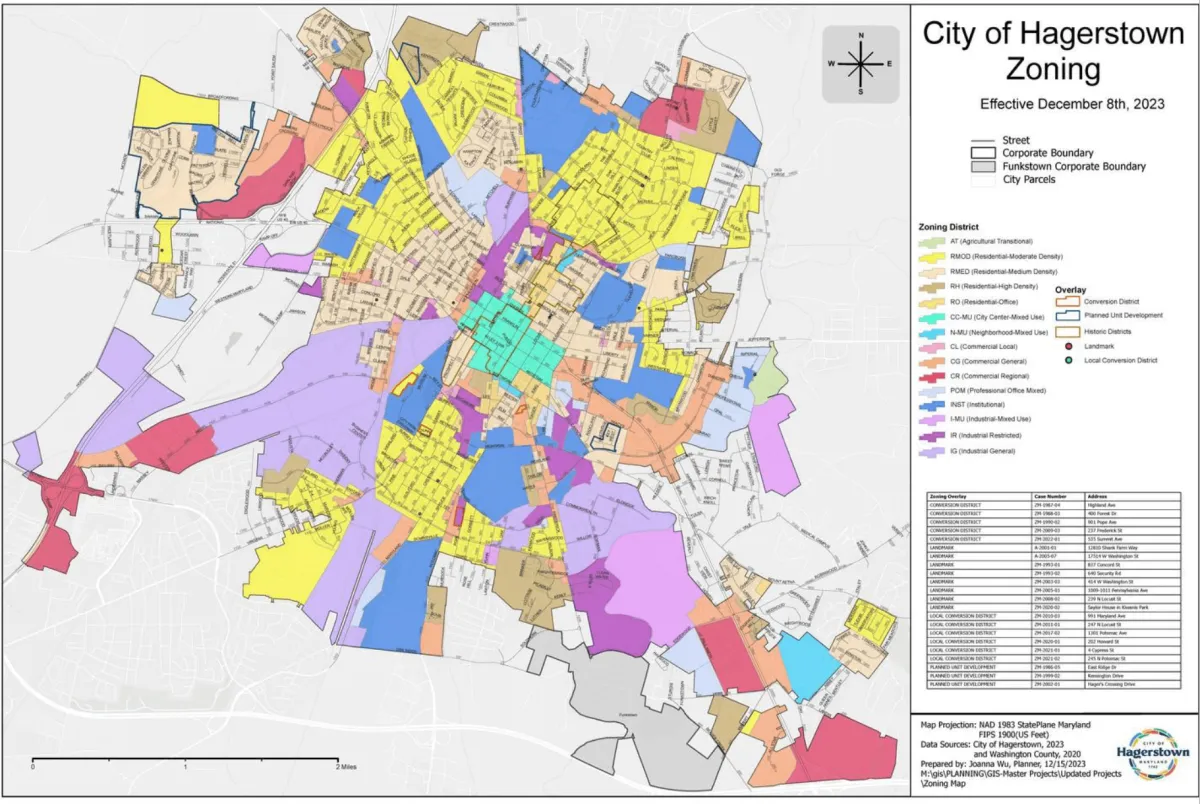

Zoning:

City Center - Mixed Use

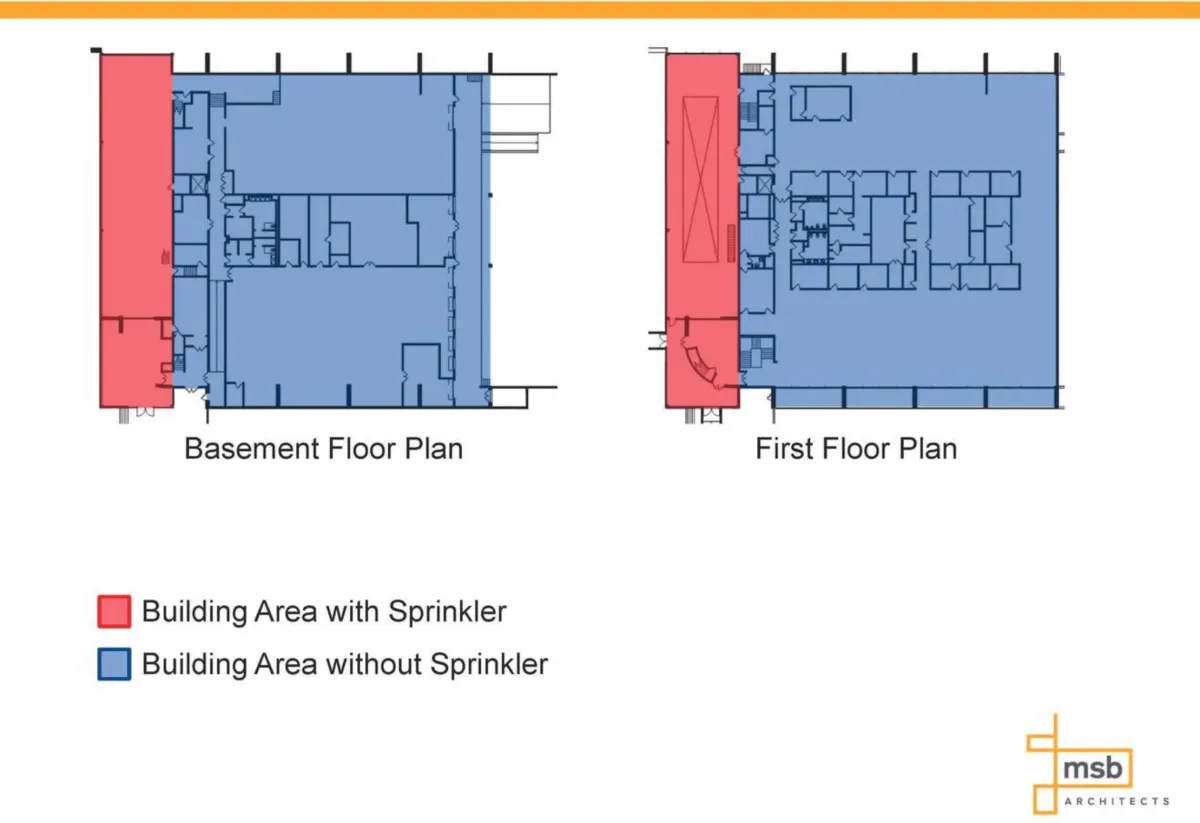

Roof:

Build-up roof, spray on foam, 3M product.

The Biz Hub

UTILITIES

Hot Water Heating- Boilers have been updated. State inspects boilers every 2years

Glessner – security (card readers, fire alarms, smoke detectors)

Antietam Broadband – WIFI to run security cameras

ARC Water Treatment Company

Columbia Gas of Maryland

Hagerstown Light Department

Hagerstown Water & Wastewater Department

Mettel: Security line

Verizon: Elevator Phone

PARKING

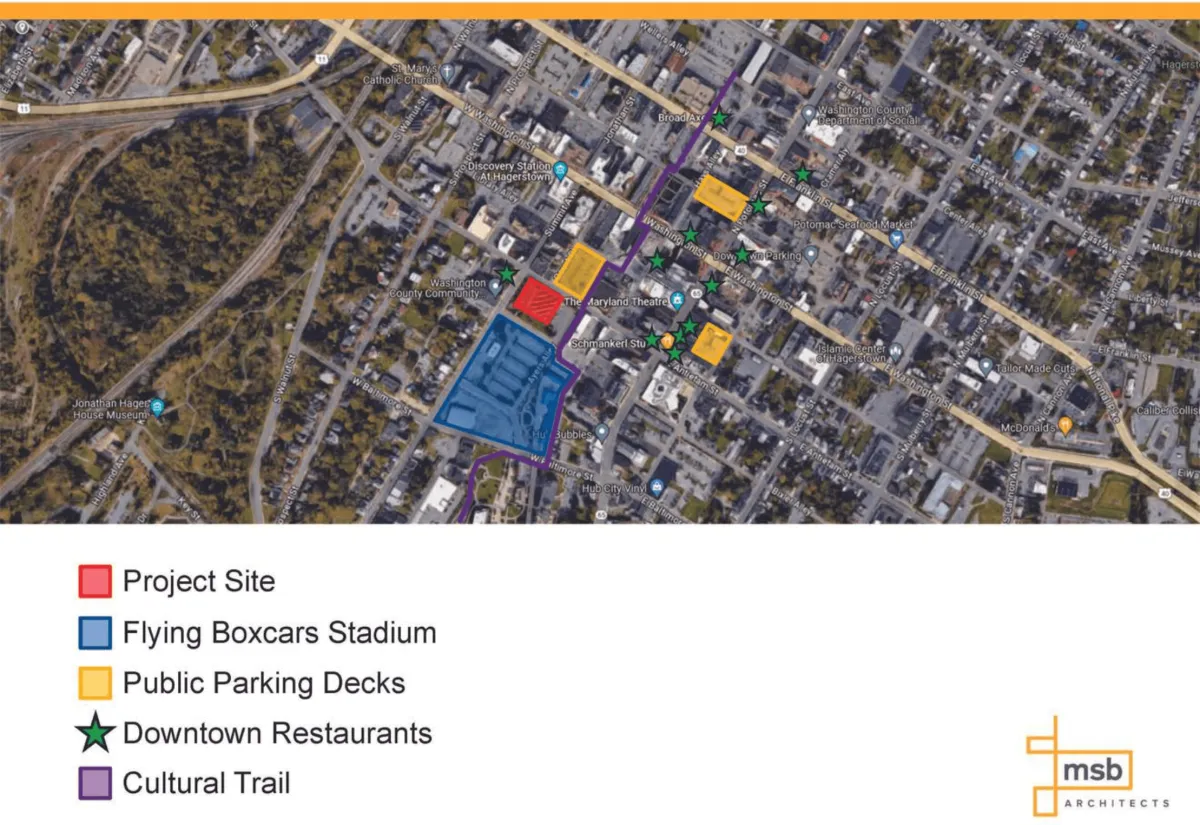

There is room behind the building to park, and space on the side of the building. Approximately 20-25 spaces onsite.

Hagerstown’s new parking deck will be located directly across the street and will have 397spaces.

Nearby is ample street parking, a 440 space parking garage at 25 N Potomac and a 185space parking garage at 25 Renaissance Way

17 Years

in business

$3M

Historical Activity

$2M

Assets Under Management

8

Realized Projects

1

Private Offering

The Biz Hub On-Site Live Stream

Join The ARV Land Holdings CEO, Norvan Daniel III, as he offers a behind-the-scenes look at The ARV Land Holdings’ screening of the Biz Hub Apartments - currently open for sale on the Marketplace.

Live Q&A starts on July 16, 2024 at 3pm PT

Live Q&A starts on July 17, 2024 at 9am PT

Property Overview

Address:

100 Summit Ave, Hagerstown, MD

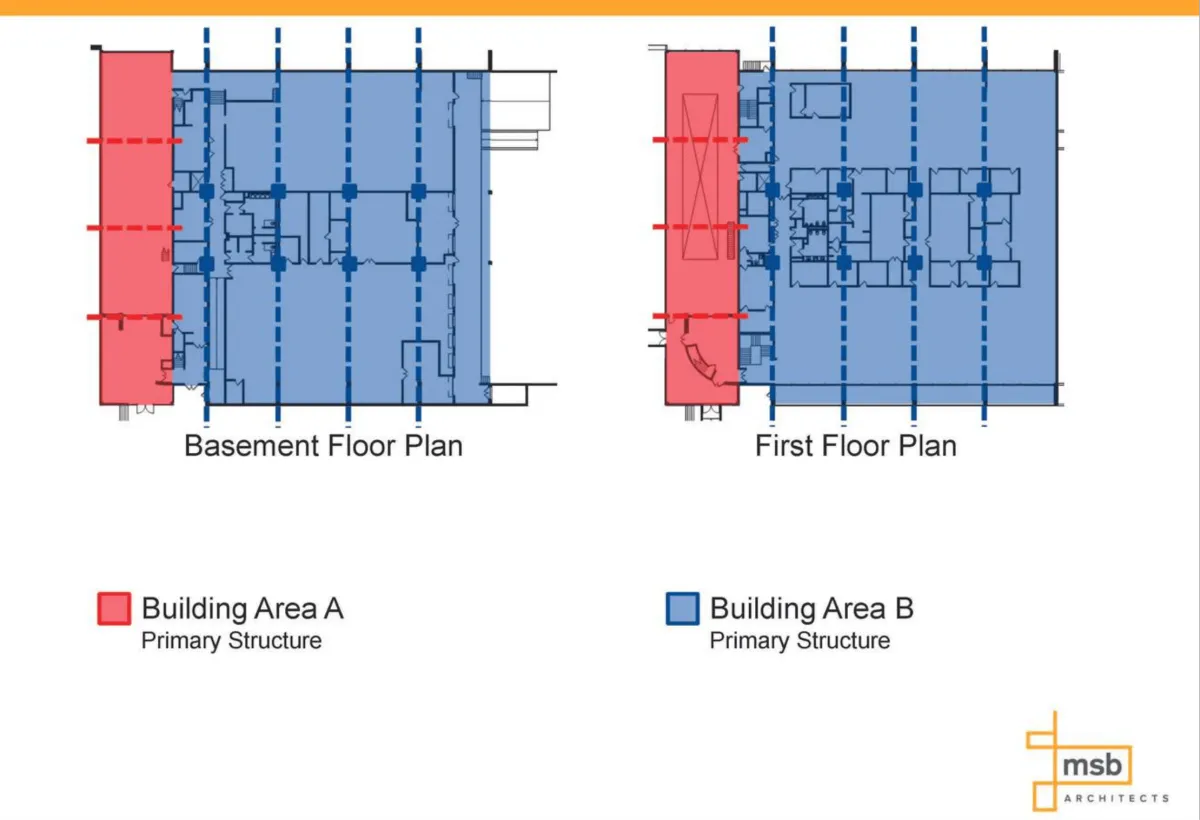

Building Size:

53,514 sq/ft

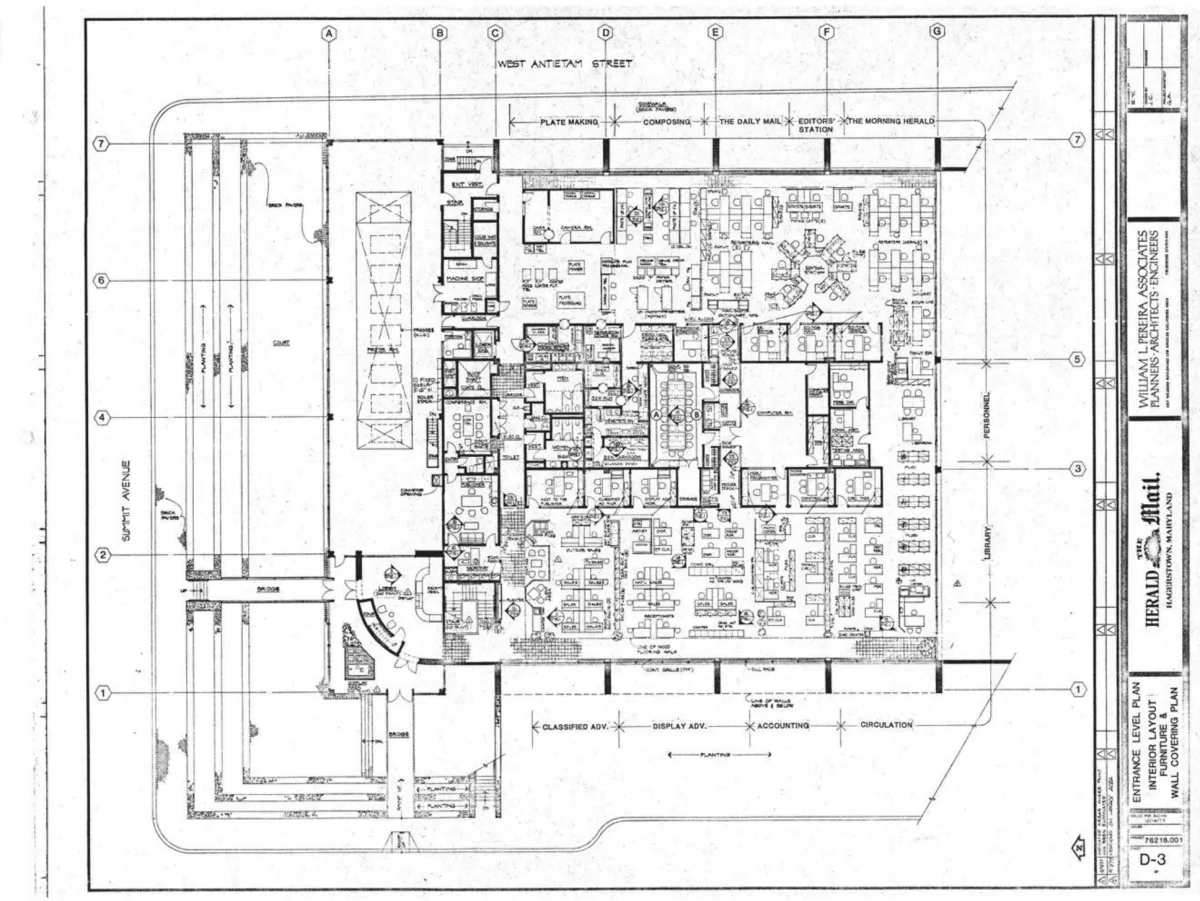

Year Built:

1979

Property Description:

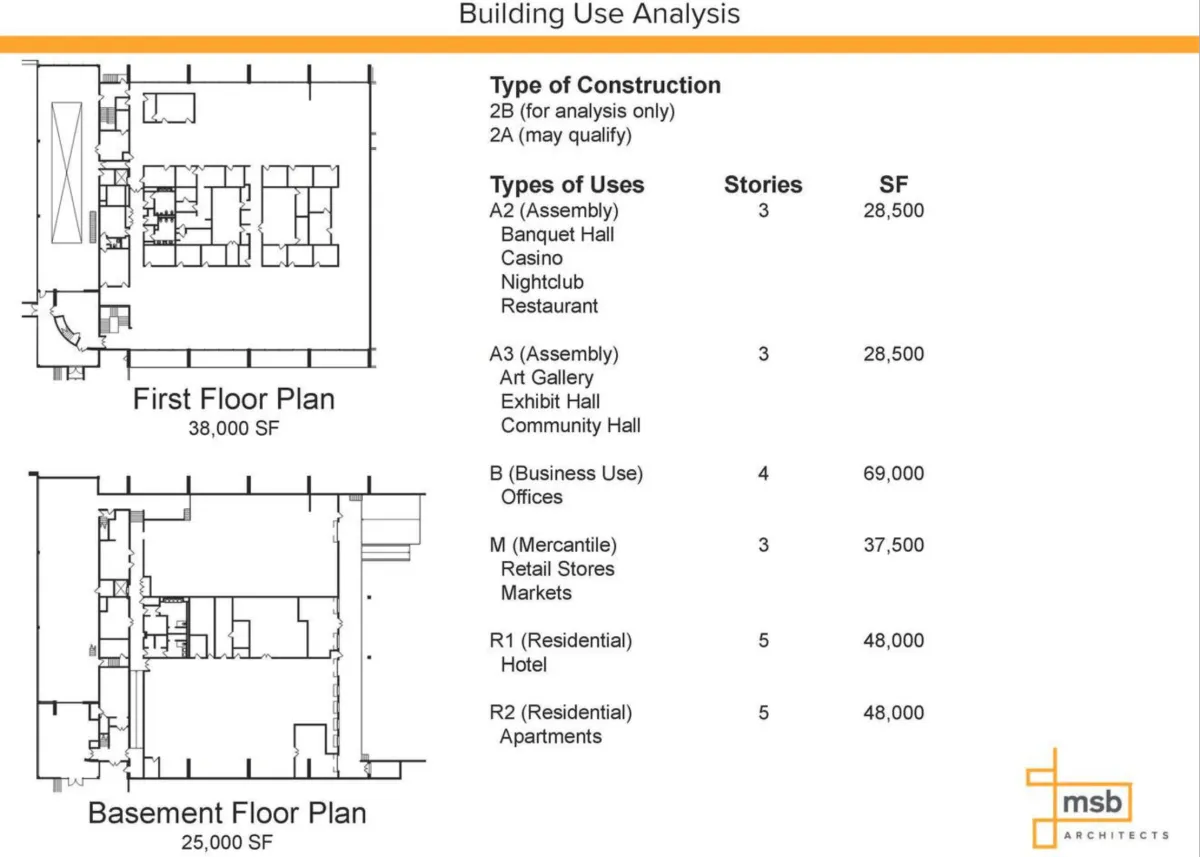

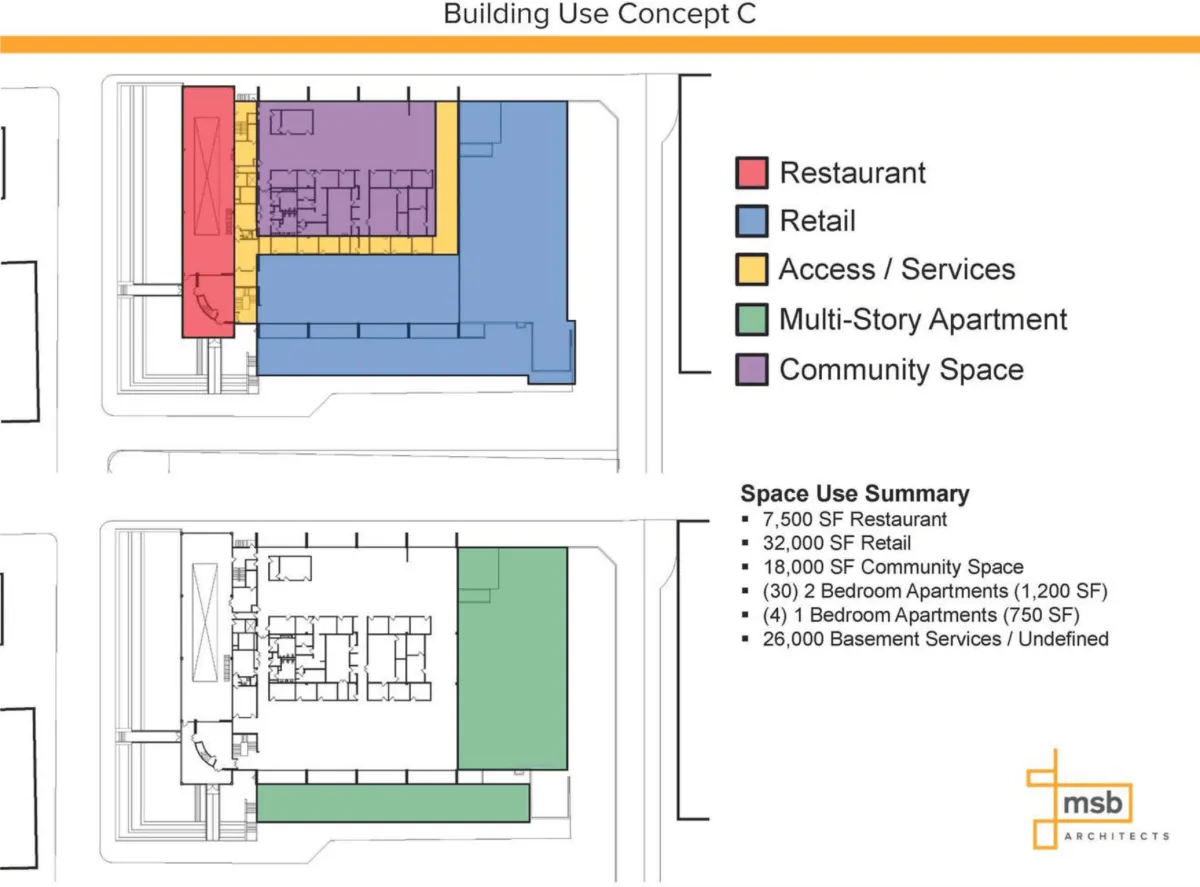

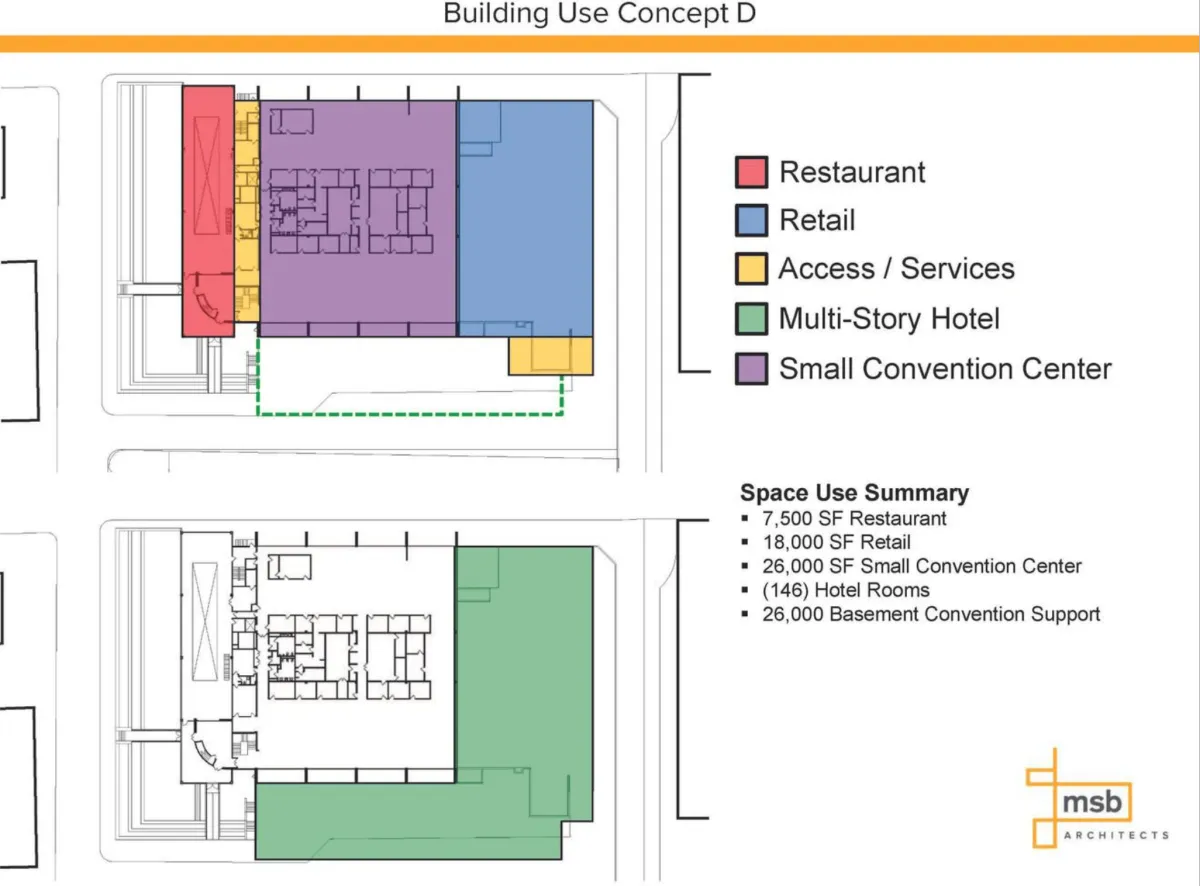

Multi-use office building with unique design features, including a two-story space ideal for hospitality or restaurant space.

Current Condition:

Recently used as The Press Room event space, with large open office areas and a basement ideal for storage or flex space.

Zoning:

City Center - Mixed Use (CC-MU)

Location Benefits:

Proximity to the new Meritus Park baseball stadium and the construction of a new parking garage directly across the street.

Pre-Recorded Deal Presentation

Recorded with ARV Land Holdings Partners on June 12, 2024.

Live Q&A

ARV Land Holdings Partners answered investors’ questions about this opportunity. Recorded on June 25, 2024.

Why This Deal

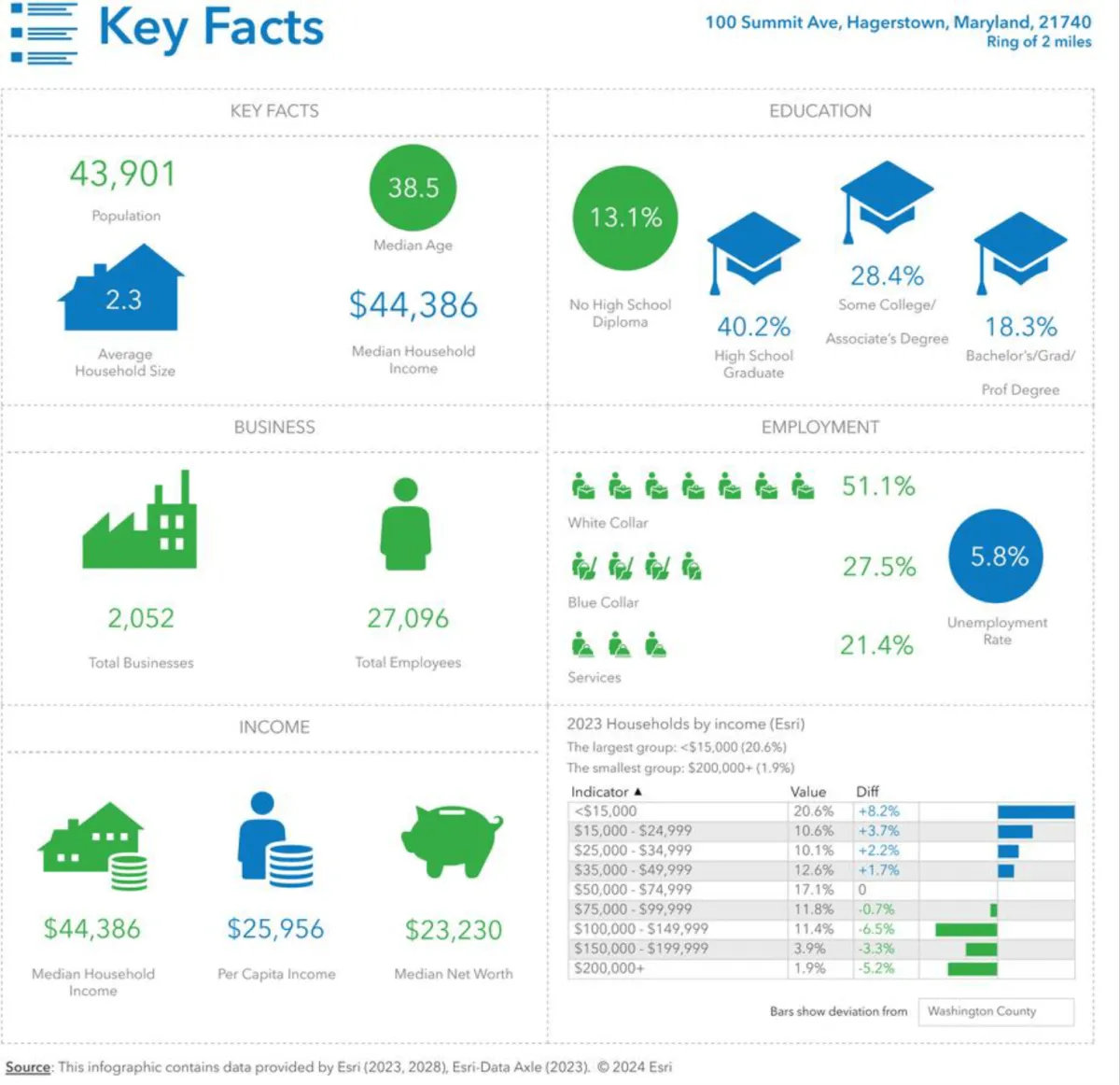

Market Opportunity:

Market Analysis: Hagerstown is undergoing revitalization, driven by new developments such as the Meritus Park baseball stadium.

Economic Impact: Increased foot traffic and economic activity in the downtown area.

Target Demographic: Small to medium-sized businesses, entrepreneurs, and professionals.

Competitive Advantage: Comprehensive business support and development services, diverse amenities.

Investment Strategy:

Business Model: Provide a range of business services and amenities, creating a community for business growth.

Revenue Streams: Workspace/office leasing, media and production services, event hosting, catering and food services, fitness and recreational services.

Lease Structure: Flexible leasing options to attract a variety of tenants.

Capital Improvements: Renovation of the building and setup of a full-scale media and production center.

Financial Projections:

Total Annual Operating Expenses: $869,603

Capital Investment for Studio: $1,000,000

Initial Lease-Up Costs: $13,378

Working Capital (3 months of operating expenses): $217,401

Total Capital Needed: $2,100,382

Revenue Projections: Detailed projections for various revenue streams.

Projected NOI: $2,898,397

Cap Rate Analysis:

Baseline Cap Rates:

6% Cap Rate: Required NOI: $209,400

8% Cap Rate: Required NOI: $279,200

10% Cap Rate: Required NOI: $349,000

12% Cap Rate: Required NOI: $418,800

Offering memorandum

Financial reporting

Market research

Risk analysis

Track record

Background checks

Market research

Investor reference check

Economic Impact

Stadium and Team Collaboration:

Coverage

Media & Branding

Promotion

Advertising

Co-Events

Children's Entertainment

City:

Hub for Local Business Growth and Innovation

Tech Hub

Workforce Development

Youth Development and Educational Experience

Mini-Convention & Event Center

Businesses:

Virtual Back Office Headquarters, VBO Hq

Solo to CEO Command & Capabilities

E-commerce Hub

Media & Broadcast Production Hub

Strategic Growth, Growth via Customer Acquisition, and Product-led Innovation

Local Residents:

Workforce & Career Development & Opportunities

Support And Facilitate Local Entrepreneurship

Children's Education & Experiences

Improve Quality of Life and Local Experience

Education & Entertainment

Building Ownership:

Receive Full Asking Price

Lock In Buyer

Cash Flow Asset in 6 months versus Development Timeline or Extended Sale Timeline

Participate In Profit Share

Disposition Asset In 3 Years

The Deal

Opportunity Zone Benefits

Tax Incentives:

Significant tax advantages for investors due to the Opportunity Zone designation.

Investment Growth Potential:

Potential for substantial appreciation and tax benefits.

Long-term Benefits:

Enhanced return on investment through tax incentives and property appreciation.

Project Timeline

Phase 1:

Lease-up and initial capital investment for studio setup (Year 1).

Phase 2:

Incremental improvements and full-scale operations (Years 2-3).

Phase 3:

Continued development and optimization (Years 4-5).

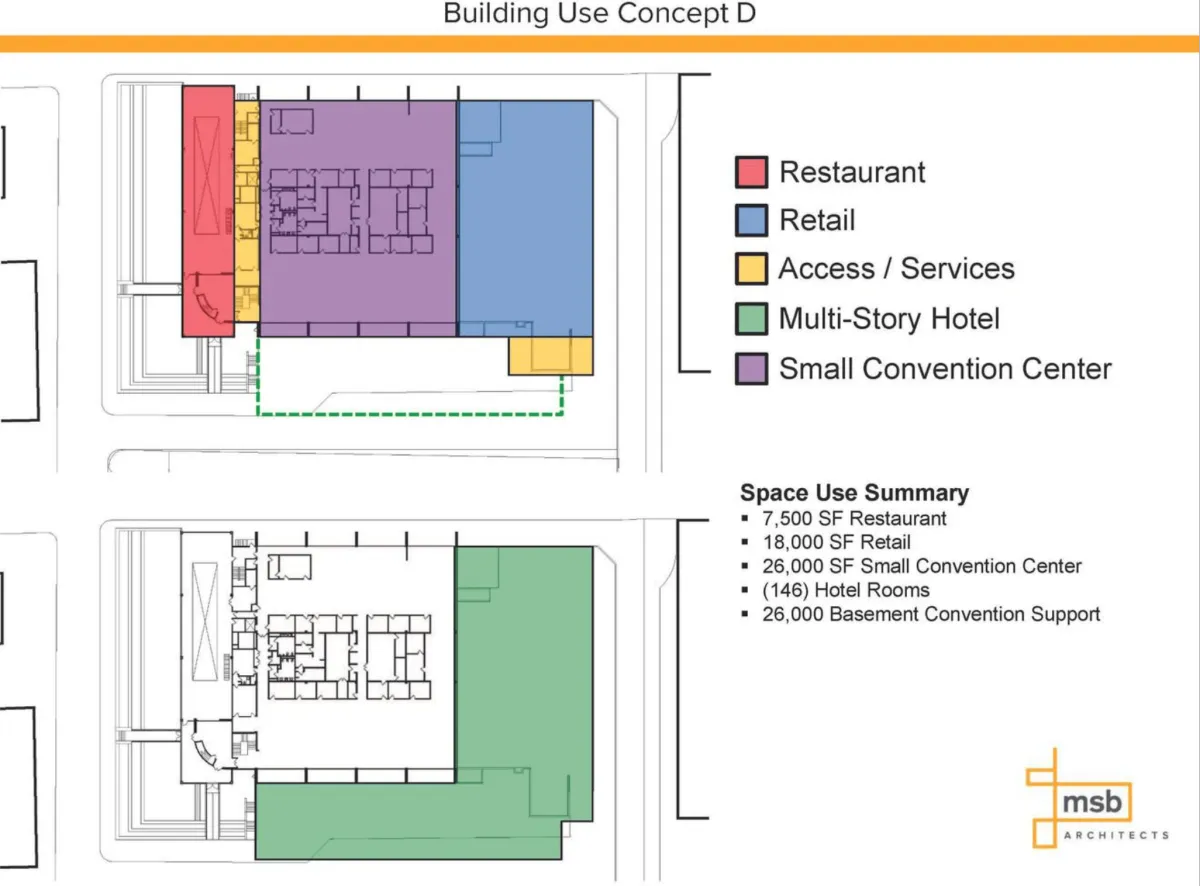

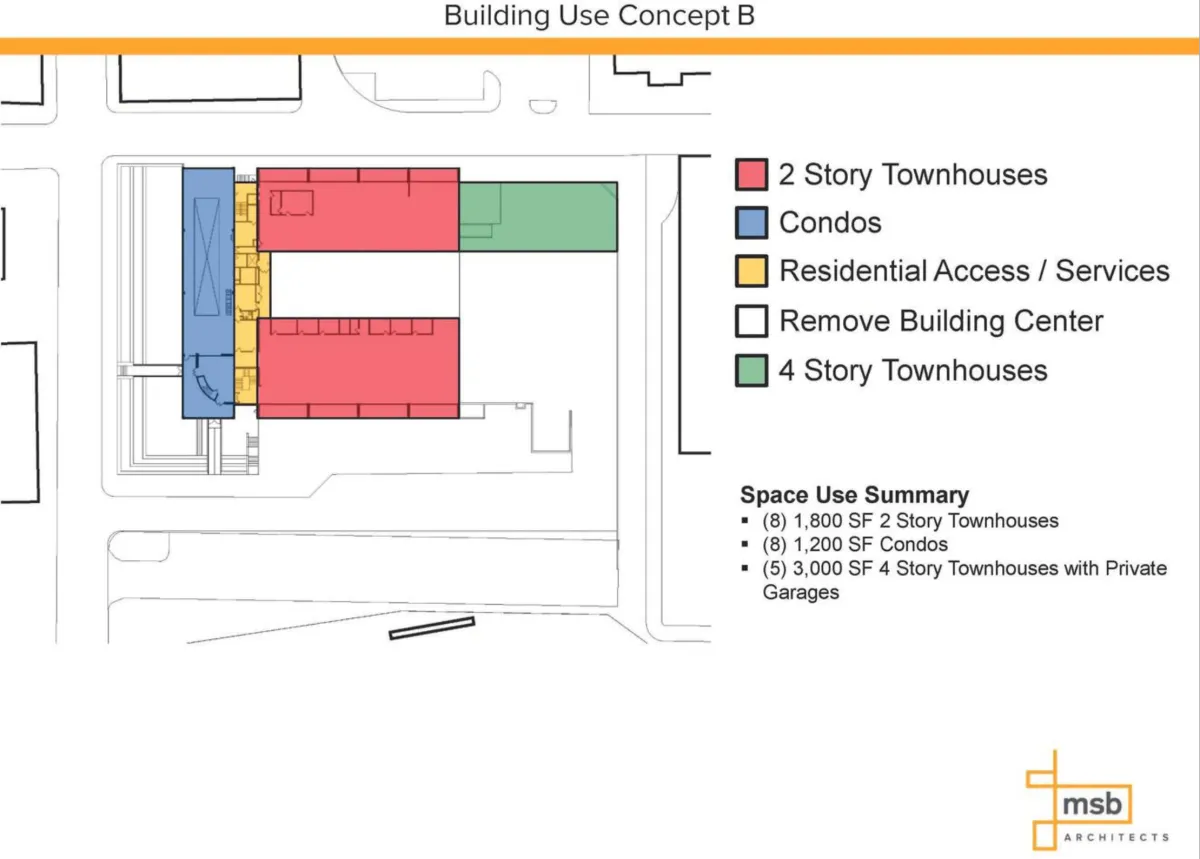

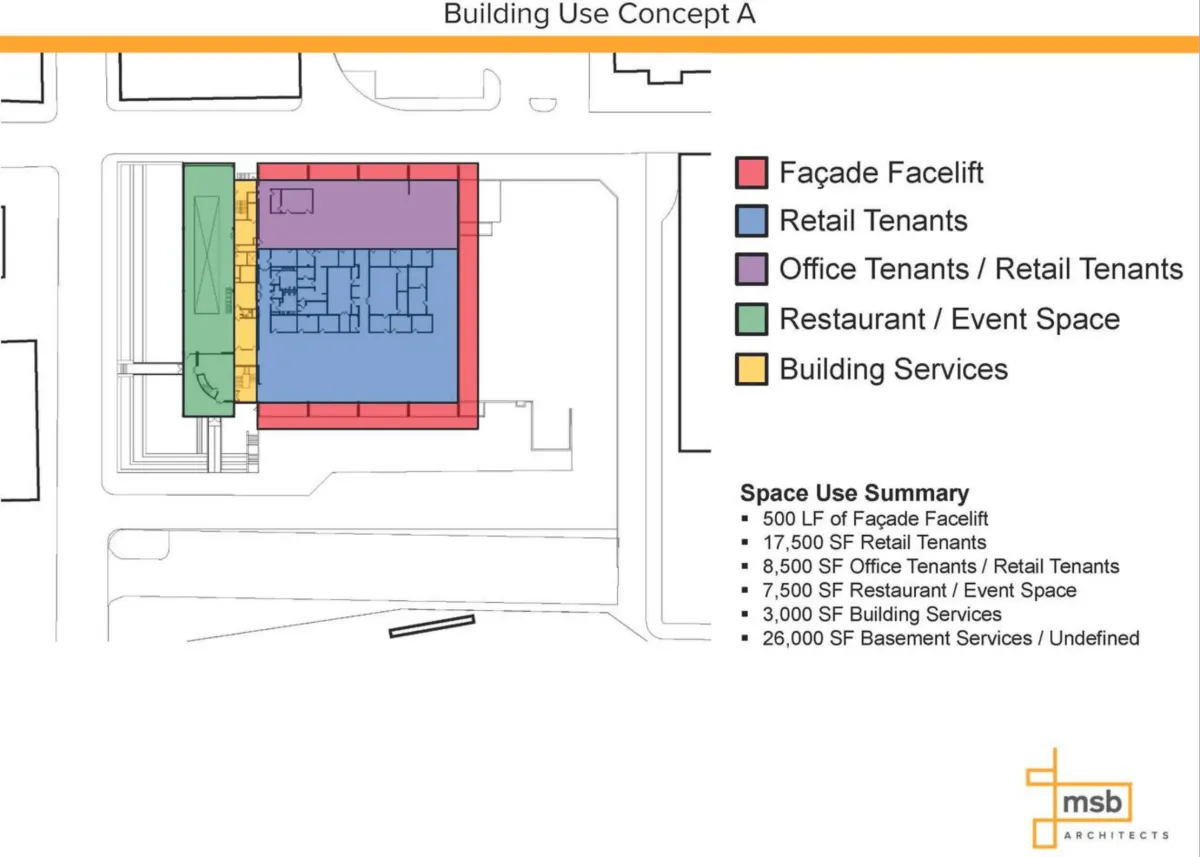

Development Plan

Workspace/Office Concept:

Offer various membership levels and private offices.

Media and Production Services:

Provide state-of-the-art media production facilities.

Event and Convention Center:

Host events and provide catering services.

Fitness and Recreational Services:

Offer a functional fitness center and children’s gaming space.

Collaboration with Baseball Team:

Engage with the community and support local events.

Management Team

Development Team:

Experienced real estate professionals and business strategists.

Management Experience:

Proven track record in property management and business development.

Track Record:

Detailed history of successful projects.

Investment Summary

Equity Investment Needed:

$2,100,382

ROI Potential:

Attractive returns driven by diverse revenue streams and Opportunity Zone tax benefits.

Exit Strategy:

Potential for refinancing, sale, or continued operation with strong cash flow.

The Sponsor | ARV Land Holdings

Founded in 2023, ARV Land Holdings, INC is a Maryland-based investment firm specializing in acquiring, managing, and repositioning, what they consider, well-operated land, multifamily and residential, and commercial properties in and around growing metropolitan markets. They focus on adding value through management of on-site operations that maximize the use and value of the property, accelerate and optimize the cash flow of the asset. Currently, ARV has more than $2 million AUM, of income generating properties located in Maryland and Pennsylvania, and a 10-acre farm in Texas. ARV emphasizes financial performance while improving the value and cash flow of assets.

17 years

In Business

$3M

Historical Activity

$2M

in AUM

8

Realized Projects

1

Private Offering

Get to Know The Hub City Business Hub

In this video, we introduce Tayo Osesina, Managing Partner of

The ARV Land Holdings, as he explains the ARV Land Holdings’ investing approach.

Contact Information

Project Lead:

Norvan Daniel III